With over a century of exploitation, Romania's natural gas fields have been in decline, although companies in the sector are investing heavily each year to stabilize production. But oil projects in the Black Sea may compensate for this decline in onshore production. Romania already has more than five decades of experience in the offshore area, so that about one in ten cubic meters of natural gas produced in the country now comes from deep offshore. With the discoveries made in 2012 in the deep offshore area, the potential is to significantly increase this production. How complex is this process, whereby gas molecules are extracted from the depths to reach our homes or the thermal power stations that produce the energy we need when we turn on the lights?

Projects to exploit offshore hydrocarbon resources are among the most sophisticated engineering projects, with state-of-the-art technology and specialized personnel playing a key role. The process of extracting natural gas resources to reach consumers is long and involves huge investment efforts, which we explain in detail below.

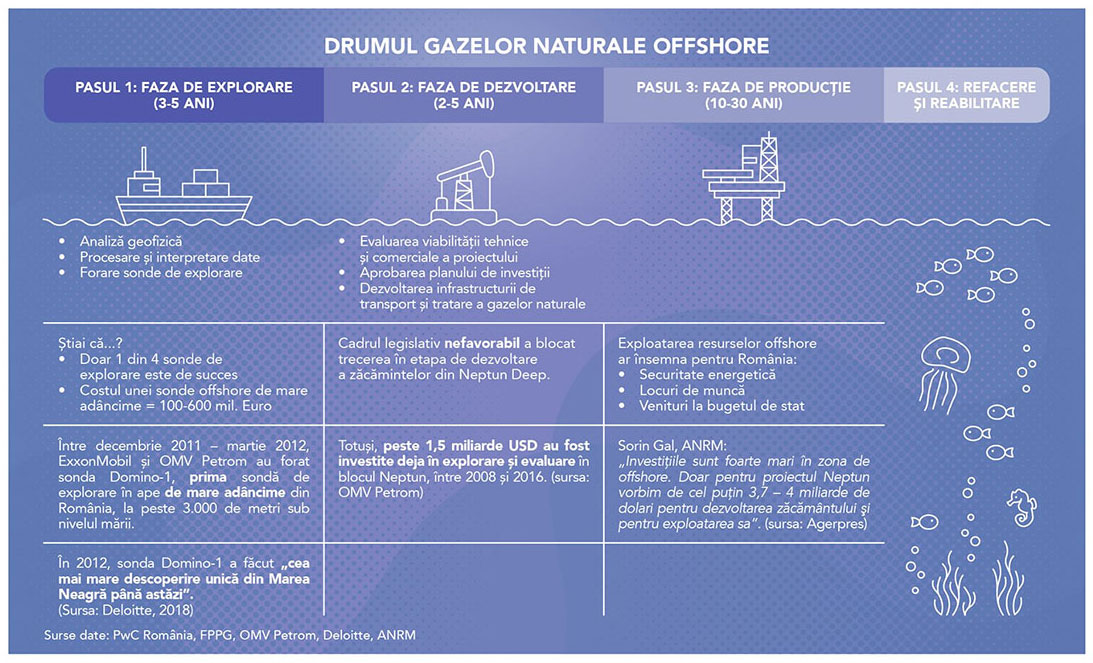

This journey begins with the deep-sea research phase to identify available resources, the first of the three main stages in the life cycle of an offshore project: exploration (1), development (2) and production (3). Typically, for deep offshore projects, the total duration of the three phases is up to 30 years.

Viitorul Energiei has summarized, in the following infographic, this route oil companies have taken to identify and extract offshore natural gas resources:

Moving beyond technological limits: towards ever deeper waters

Globally, "Off-shore exploitation started to become significant in the 1970s and 1980s, when the largest deposits were discovered in shallow waters. As the more easily discoverable and exploitable reserves began to be depleted, international oil companies (Supermajors) turned to into deeper and deeper watersand the share of natural gas has started to increase in total discoveries", the analysis states "Challenges of deep offshore deep-sea exploitation. The state of the Black Sea"published by the Energy Policy Group (EPG).

The situation is similar here. "In Romania, offshore oil projects started in 1967-1969. Their aim was to increase national production by accessing drilling and exploitation potential on the Black Sea continental shelf", according to the Romanian Association of Offshore Concessionaires in the Black Sea (source, here). Since then, here is how we have progressed, thanks to technological advances and huge investments:

- In 1975When the first offshore drilling platform was installed in the Black Sea, the first well was drilled in an area where the water was 84 meters deep.

- Between December 2011 - March 2012, ExxonMobil and OMV Petrom have drilled the Domino-1 well, Romania's first deep-water exploration well to confirm the presence of natural gas. Domino-1 reached a total depth of more than 3,000 meters below sea level. This was made possible using cutting-edge technology (details, here).

"The way deepwater exploration is now done was unthinkable 20 years ago. Vessels, drilling rigs, but also processing technology - all have made enormous advances in the last two decades"writes one of the world's leading energy experts, Vasile Iugain the analysis published by EPG.

To better understand the process of bringing offshore natural gas resources to the surface, we detail these steps below, described in EPG analysis:

In the exploration phase, an investor incurs costs related to geoscientific and environmental studies, appraisal wells, exploration work, acquisition of rights to exploit, seismic surveys, etc.

If the seismic and geological data and the results of the exploratory boreholes are analyzed and the investment decision is made, the following development phaseduring which time the investment plan is being implemented at very high costs.

Investments and huge risks taken by investors

What is very IMPORTANT TO KEEP IN MIND: On average, for seven years from the start of a deepwater oil and gas project, the investor has only cash outflows and zero income inflows.

For deepwater projects, production starts on average about 7 years after project start-up, unlike onshore (onshore) and shallow water projects.

With production phase, revenues start to appear, and the FIRST PROFITS are generated about 10 years after the project startsrespectively 2-3 years from the start of production.

In production phase there are other cash outflows, represented by fees, royalties, taxes and operational expenses.

At the end of the economic life of the project, there are costs of closing or abandoning the deposits and of rebuilding or restoring the area, including dismantling infrastructure.

To get an even clearer picture of the complexity of this type of projects, we invite you to watch the following video infographic:

In addition to the significant investment required and the long payback period, these offshore projects are carried out in high-risk conditions. When making the investment analysis of the project, the following is taken into account total project risk and the higher it is, the higher the expected profitability. In itself, investment decisions are like big, risky, long-term bets, where the investment is recouped over a long period of time.

Here are the main risks, described by analysis by Vasile Iuga:

- Uncertainty about resource potential

- Infrastructure and logistics

- Trade risk and oil price fluctuations

- Project management

- Environmental risks

- Reputational risk

- Political or geopolitical risks

- Tax risks

The Covid-19 pandemic and the ambitious targets set by European Union representatives to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 expose the natural gas sector to a number of new risks and uncertainties. Currently, "European policies on whether gas investments can be classified as green investments are relatively ambiguous", show PwC Romania, in "Comparative study on specific taxation of offshore gas production in Europe", recently published by the Federation of Oil and Gas Employers (FPPG).

Overpricing of offshore gas sector blocks investment

The tax regime applied to the offshore gas sector is a key component for economic operators in their investment decision, especially in the current context of energy transition. And yet, the Romanian authorities continue to maintain too high a level of taxation, thus blocking investment decisions in the deep offshore perimeter (Neptun Deep), where considerable natural gas reserves have been identified since 2012.

"In 2020, Romania had the highest effective tax rate for the offshore gas sector (23%) of the relevant European states for offshore production, about 4.3 times their averageThis high level of effective taxation shows the need to change the tax regime to make it attractive to investment, all the more so in the context of the energy transition. Thus, In order to restore the balance and competitiveness of the tax system, it is necessary to amend the Offshore Law (Law No 256/2018)", says the study conducted by PwC Romania, which you can find here HERE.

We face a historic opportunity for the country's economic development: the deposits in the Black Sea, but we risk missing it. Only a competitive fiscal and regulatory framework will unlock the large-scale investments needed to develop the Black Sea gas projects. These investments will bring economic and geo-strategic benefits to Romania, while securing the necessary resources to achieve the decarbonization objectives of the current European Green Deal. Time is not running out in our favor.