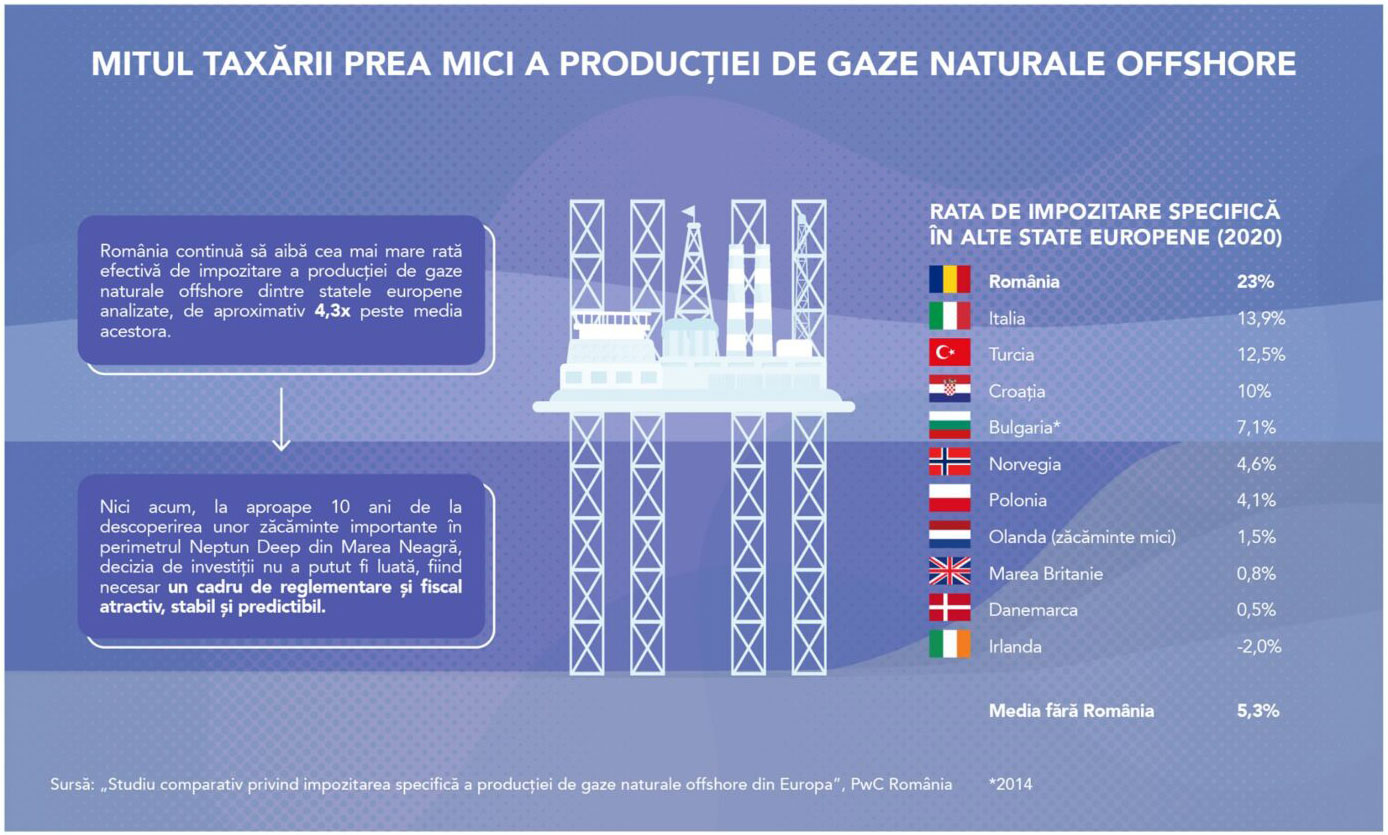

The energy sector is one of the biggest contributors to the state budget. However, to maximize the benefits, a balance is needed between the interests of the state and those of investors. When this balance breaks down, projects are blocked or cancelled. While Norway, for example, reduced taxation on companies in the hydrocarbon production sector in 2020 in order to stimulate investment, Romania continues to maintain a level of taxation well above the average in other European producing countries.

Due to uncompetitive fiscal terms, coupled with fiscal and legislative instability, investments for the development and exploitation of natural gas fields in the Black Sea have been put on hold for several years. Not even now, almost 10 years after the discovery of important deposits in the Neptun Deep perimeter in the Black Sea, The final investment decision could not be taken in the absence of an attractive, stable and predictable legislative and fiscal framework.

In the hydrocarbon (oil and gas) production sector, experts recommend that tax terms to take into account the profile of the deposits and reflect the difficulties of exploring, developing, extracting and bringing resources to market.

"It is not possible to impose similar tax terms on onshore as on deepwater, and the same is true for rich and marginal deposits. It is found that globally, lower total risk areas are taxed at a higher level, whereas in high-risk areas, such as deep offshore offshore, taxation is generally lower", the analysis "Challenges of deep offshore. The state of the Black Sea", published by Energy Policy Group (EPG).

Thus, some countries are adopting moderate taxation to attract investment, especially in areas where significant discoveries have not yet been made. On the other hand, in the case of easily exploitable deposits with high production and profitability, where investors have already recouped their investments, the level of taxation tends to be higher.

The stability of the fiscal framework over the life of the project is equally important for companies in the sector, which make significant investment decisions with long payback periods.

"The tax risk increases especially after the investment has become irrevocable and the investor cannot withdraw. Changing tax terms during the life of a project can significantly affect the profitability parameters and even the viability of the project. This is why it is essential to adopt stability and predictability clauses before the start of projects", according to the EPG analysis cited above.

A look at the "tax burden" in Romania

Despite this need for stability and predictability, but also for an attractive tax framework - valid for any investor from any corner of the world, regardless of the field of activity - Romania has in recent years decisions that have affected investment in the oil and gas sector, impacting local production.

Below is a brief description of the current fiscal framework. Looking at offshore gas projects, the specific taxation applicable to offshore petroleum concession agreement holders has two components:

- Oil royalty, established by Oil Law 238/2004

- Tax applicable to additional offshore income, established by Art. 19 of the Offshore Law no. 256/2018

Royalty rates currently applicable are between 3.5% and 13%, based on the quantity of gross output per quarter. At the moment, "the current law does not provide for differentiated royalty regimes applicable to onshore and offshore production", explains a comparative study on the specific taxation of offshore gas production in Europe, carried out by the consulting and auditing company PwC Romania.

For most offshore gas production, the maximum quota of 13% is applicable. However, the reference price for calculating royalties is not determined on the basis of the actual realized sales price of natural gas, which is fundamentally the wrong approach as it should reflect the market value of natural gas produced and sold by the Romanian oil agreement holders. According to the regulations, the Day Ahead quotes on the CEGH Baumgarten exchange in Austria, which are usually higher than those on the local market, are taken as a reference. In August of this year, for example 65% higher than the average price for transactions on the Romanian Commodities Exchange with delivery in August.

Offshore specific tax involves applying a tax rate to the difference between the selling price of natural gas and a fixed price of 45.71 lei/MWh. Anything above this threshold is considered "excess profit" and is taxed at 15-70%. However, at a price of 45.71 lei/MWh, offshore projects are not economic, so no "supra-profits" can be generated, says the Federation of Oil and Gas Employers (FPPG).

Therefore, cumulating the royalty with the specific offshore tax, Romania has reached, in 2020, an effective tax rate on offshore gas production of 23%. The level is 4.3 times higher than the average specific tax on offshore gas at EU level, which was 5.3% in 2020, according to a study by the consulting and auditing company PwC Romania.

Solutions and recommendations to reach a win-win-win situation

"This high level of effective taxation shows the need to change the tax regime to make it attractive to investment, all the more so in the context of the energy transition. Thus, in order to restore the balance and competitiveness of the tax regime, it is necessary to amend the Offshore Law (Law no. 256/2018)," the PwC Romania study states.

For the specific tax system to be competitive, it needs the elimination of the offshore specific tax or changing the price threshold at which the price starts to be calculated (45.71 lei/MWh). Also, the royalty must be related to prices realized on the Romanian marketnot at prices in other European markets.

It is also essential to ensure legislative and fiscal stability.

"The legislation impacting the Romanian offshore gas sector has been modified more than 15 times between 2013 and 2020", says PwC Romania.

It is equally important that prices on the Romanian market are allowed to form freely, without state intervention. From the investors' point of view, it is a free, competitive and functioning market that ensures a fair price signalwhich will boost output growth.

Projects in the Black Sea are highly complex. Being a poorly explored area with high geological risks, the investment risks are also high. And from risky projects, such as those in the Black Sea, project returns and the level of stability must be appropriate.

"To achieve the much-discussed win-win-win situation, in which society, the state and investors all benefit, many factors need to be happily interlinked. The materialization of a single major risk can break the project's chain, because the strength of a chain is determined by the strength of the weakest link. This is why reasonable optimism, but also realism, is needed for deep offshore projects in the Black Sea," the EPG analysis added.

Romania needs to exploit the natural gas reserves in the Black Sea to offset declining onshore production. The availability of domestic resources provides, beyond revenues and jobs, energy security, an essential aspect for the security of any state. However, Romania's development potential from the perspective of possessing this resource will diminish as the energy transition evolves and the development of alternative energy sources accelerates.

So, the window of opportunity to make the right political decisions that ensure a win-win-win situation, both for the state and citizens, and for investors, who contribute significantly to the state budget through such projects, is closing. And then it will come to a result from which we all lose.