Although it has the resources to supply all its natural gas needs for consumption, Romania is in a fragile position, increasingly dependent on imports to cover its domestic consumption. In 2021, the rate of imports has reached its highest level in the last 10 years, reaching almost 30%, amid declining production and discouraged investment in the exploitation of new fields. Without the development of new gas projects, imports could rise to over 50% in 2030.

"We often take energy for granted and only feel its importance in situations where we cannot benefit from it. However, energy is a building block for the economy and for our daily lives, and access to our own resources is fundamental for security of supply," said Christina Verchere, CEO of OMV Petrom, in an interview with Agerpres.

"Unlike other countries in the region, Romania has a low degree of dependence on imported gas and, most importantly, has the resources to supply all its gas needs. But it is in a fragile position, domestic production has been declining in recent years and, without the development of new gas projects, imports could rise to over 50% in 2030. How can this be avoided? By providing a fiscal and regulatory environment that encourages investment. New gas projects would contribute to both the country's energy security and economic growth"said Christina Verchere.

According to Transgaz, the operator of the national natural gas transmission system, natural gas accounts for a large share of domestic primary energy consumption, thanks to its many advantages:

- relatively high availability of indigenous resources

- reduced environmental impact

- increased ability to balance electricity produced from intermittent renewables (wind and photovoltaic), given the flexibility of gas-fired generation plants.

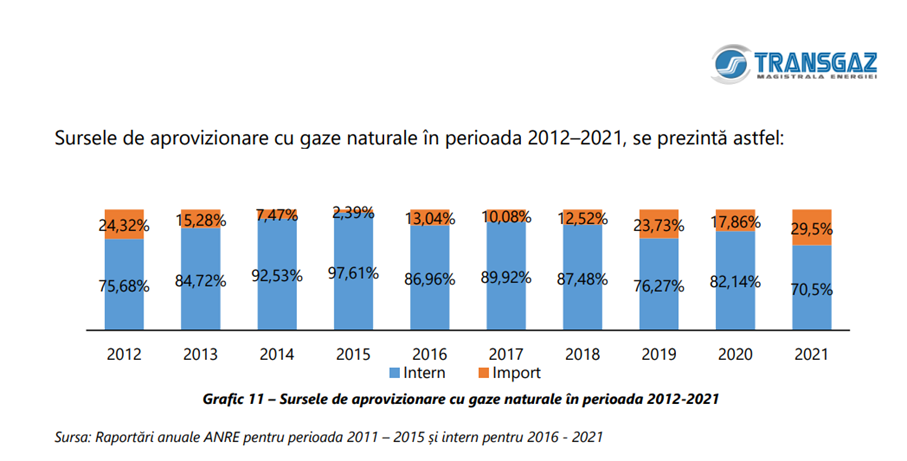

However, data published by Transgaz supports the upward trend in imports. As can be seen in the following graph, in 2021 Romania reached in 2021 the highest rate of imports in the last 10 years:

"Relatively constant domestic production between 2011-2015 and declining consumption have reduced the annual share of natural gas imports from 25.16% in 2011 to just 2.4% in 2015, but Since 2016, due to the depletion of natural gas reserves, imports have increased to 29.5% in 2021. In the coming years, it will be important for Romanian natural gas producers to keep the price of natural gas competitive with imported sources," Transgaz said in a statement. National Gas Transmission System Development Plan 2022 - 2031.

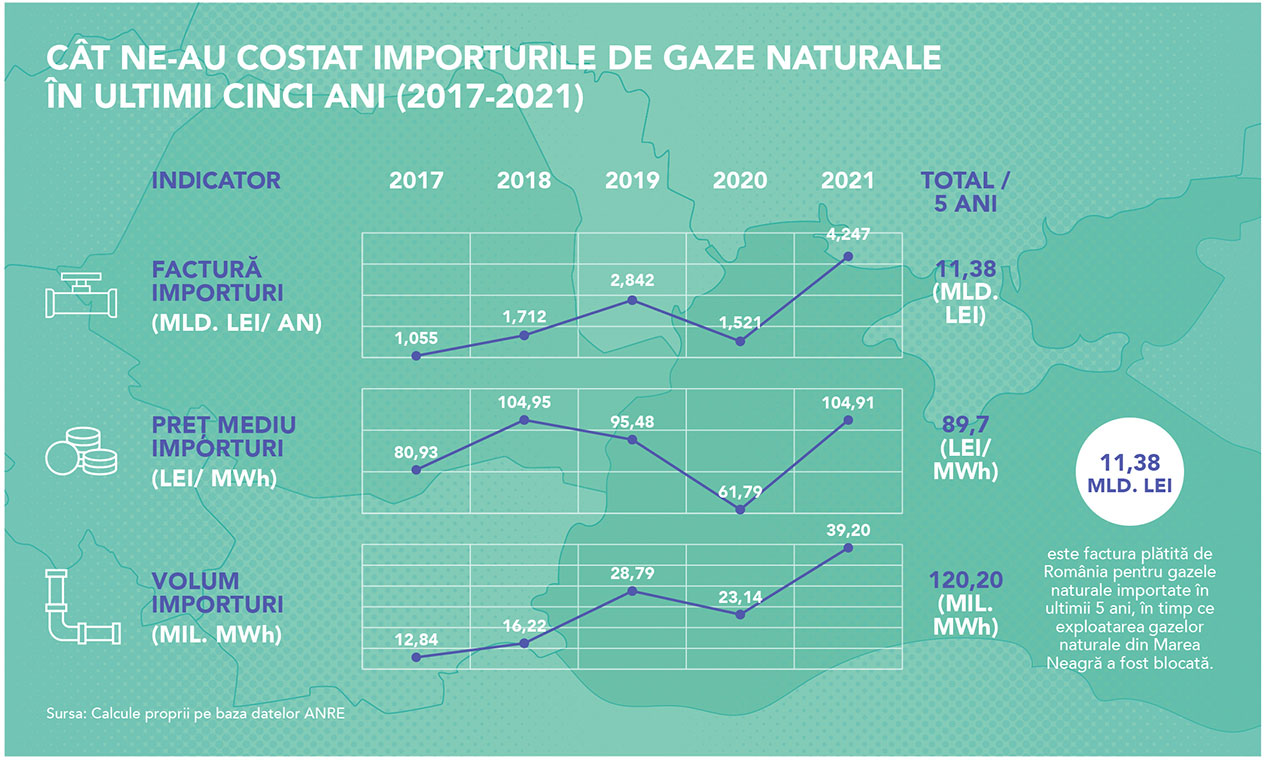

The reports on the internal natural gas market published by the National Energy Regulatory Authority (ANRE) show the same thing: a substantial increase in natural gas imports. Data analyzed and aggregated by Viitorul Energiei shows that The import bill in 2021 reached its highest level in five years:

Local producers' warnings ignored

Domestic natural gas producers have repeatedly warned the authorities about the risk of increasing imports and increasing the country's dependence on external sources of energy supply. This risk arises in a context where domestic resources remain untapped, the most important of which have been identified since 2012 in the Black Sea, in the deep offshore area (Neptun Deep perimeter).

"The uncompetitive and unstable tax regime and the introduction of specific conditions for natural gas trading have affected the functioning of the Romanian gas market and have led to the constant postponement of investment decisions in Black Sea resources", shows the Federation of Oil and Gas Employers (FPPG), an organization that brings together the main natural gas producers, covering over 98% of domestic production.

The organization recently reported that ensuring the competitiveness and stability of the tax system, with respecting the mechanisms of a free natural gas market The new Offshore Law would allow strategic investments in the production of resources in the Black Sea.

"The oil and gas industry is now at a turning point. In the current geopolitical climate, the urgent need to increase domestic production is a responsibility that both the producing companies and the Romanian state decision-makers have to shoulder, and this responsibility is not only towards their own citizens, but also towards the entire European project of which Romania is a part"said FPPG Executive Director, Cătălin Niță.

Energy prices on a rollercoaster

In the context of Russia's invasion of Ukraine, geopolitical risks have exacerbated the global energy crisis that began last year. Thus,security of supply and maintaining energy affordability have been high on the agenda of European governments in recent months. To this end, in March 2022, the European Commission drafted REPowerEU scheme - Joint European action for more affordable, secure and sustainable energy.

"Europe has been facing rising energy prices for several months, but the current uncertainty over supply is compounding the problem", says the European Commission in its REPowerEU communication.

Wholesale gas prices in Europe were on a rollercoaster in the fourth quarter of 2021, the data contained in Report on the European gas market in Q4 2021Prices were affected by geopolitical tensions rather than supply and demand principles.

"The TTF spot price (Dutch benchmark - ed. note) started the quarter at €85/MWh, rising to €116/MWh at the beginning of October, falling to €60/MWh by the end of that month and from November it comes back and reaches unprecedented levels (€183/MWh on December 21) to end the year at €60/MWh. So far in 2022, this volatility has been maintained and early Marchonce the average daily price was over 200 €/MWh", the report says.

By comparison, in the first half of 2020, amid reduced demand for energy due to Covid-19, the spot price of gas at the TTF fell to historic lows, reaching 3-4 €/MWh at the end of May 2020.

"As this period of high energy prices continues, the impact on EU citizens and EU economies will be deeper and longer-term", also notes the European Commission.

The REPowerEU plan talks about diversifying energy supply sources, especially liquefied natural gas (LNG). But there are early signs that Member States could take steps to support local production.

"Germany's government, for example, has called for an increase in domestic production as part of its plan to diversify energy sources, with the finance minister in mid-March calling for the country to rethink its ban on new oil and gas drilling in the North Sea. Outside the EU, the UK is to relicense offshore oil and gas fields and is reviewing the framework for onshore shale gas development", the "Energy stability and affordability take center stage in Europe", contained in Global Voice of Gas magazine, published by the International Gas Union.

Currently the EU's second largest producer of natural gas after the Netherlands, Romania needs to take its own measures to mitigate national vulnerabilities in terms of energy security, through a "REPowerRO" type plan. And in this plan, the development of national resources should be a priority, this measure being more important than ever in the current geopolitical context. And natural gas from the Black Sea will help Romania to stop relying on imports to meet all its consumption needs, while also helping to meet the country's carbon reduction targets.