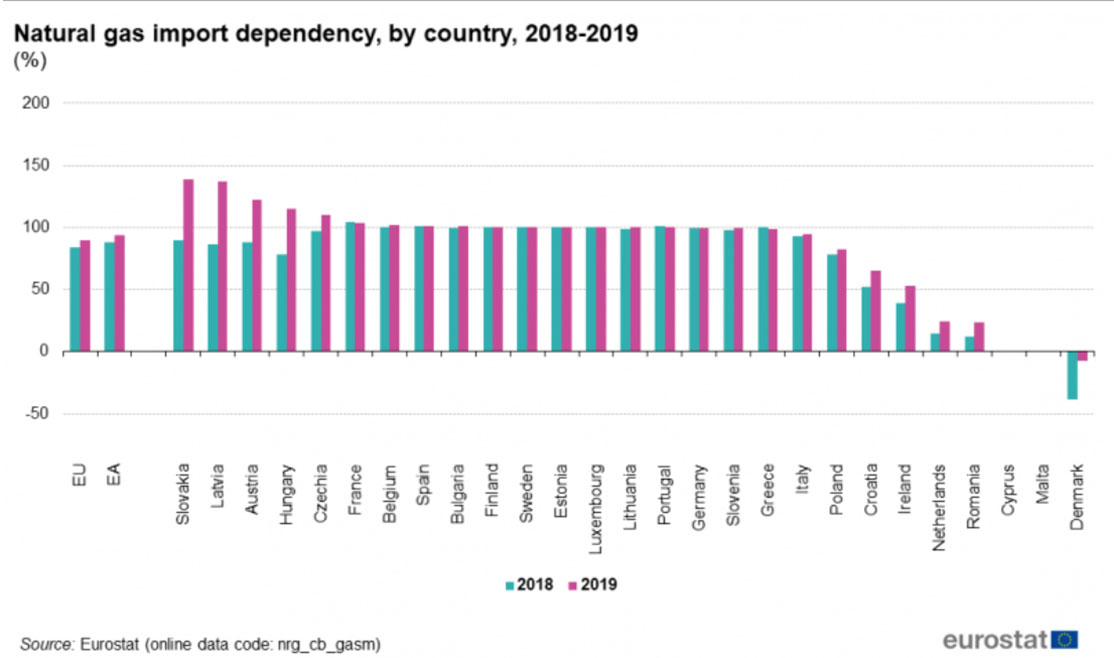

Thanks to its domestic production, Romania has one of the lowest levels of dependence on natural gas imports in the EU. The exploitation of local resources ensures energy security, significant revenues for the state budget, jobs and much lower import bills than other Member States. However, the natural decline in mature fields and legislation that makes it difficult to invest in the field are leading to a decline in current production, decline expected to accelerate without Black Sea production.

Eurostat, the EU's statistical office, in the graph below shows that Romania is doing very well compared to other Member States in terms of dependence on natural gas imports.

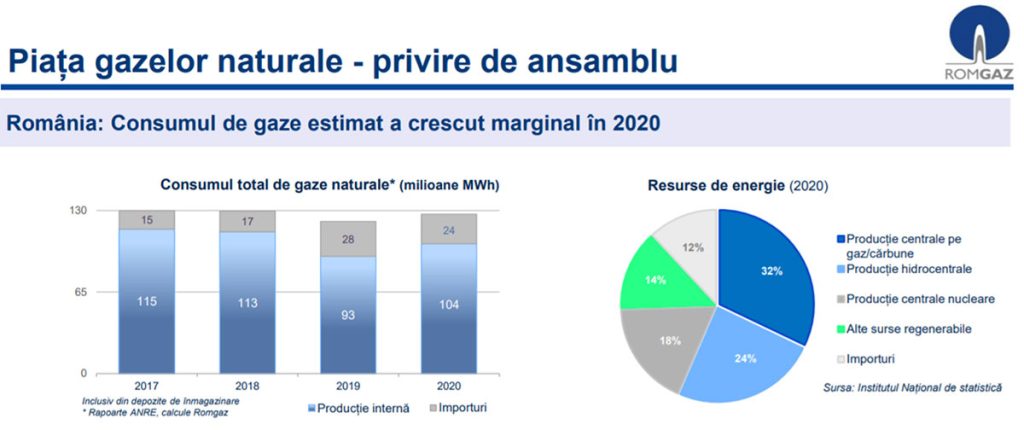

However, over the past four years, imports needed to cover the entire domestic consumption have continued to increase, from around 11% of consumption in 2017 to a peak of 23% in 2019, according to data published by the state-owned company Romgaz, the largest national producer of natural gas (source, HERE).

Analysing the monthly reports for the natural gas market published by the National Energy Regulatory Authority (ANRE), according to GDR calculations, the average annual price of imported natural gas varied as follows:

- about 81 lei/MWh in 2017

- around 105 lei/MWh in 2018

- around 95.5 lei/MWh in 2019

- around 61.2 lei/MWh in 2020

Thus, our calculations show that In the last four years alone, Romania has paid a total import bill of more than 7 billion lei (€1.5 billion). Estimated, if we had zero domestic production, at the same price of imports and the same domestic consumption, Romania would have paid an annual bill for imported natural gas of over 40 billion lei (over 9 billion euros) in the period 2017-2020., according to GDR calculations.

This huge amount would have gone into the accounts of other producing countries. Thanks to domestic production, Romania therefore saves billions of lei every year, money which in turn supports local industry and the revenue generated by this sector to the national budget.

Romania, the second largest producer in the EU, but dependent on imports

Romania is the second largest producer in the EU, but the quantities produced are not sufficient to cover domestic consumption. In addition, production is declining, as confirmed by data published by the European Commission.

If last year the Netherlands produced 24 billion cubic meters of natural gas (bcm), compared to 33.7 bcm in 2019, Romania is in second place - a long way behind the first place, with a production of only 9 bcm (compared to 10 bcm in 2019). Germany came third with 4.9 bcm (compared to 5.7 bcm in 2019). At EU level, total production last year was 54.4 billion cubic metres (bcm), down from 70 bcm in 2019, according to European Commission data published in a quarterly report on the European gas market.

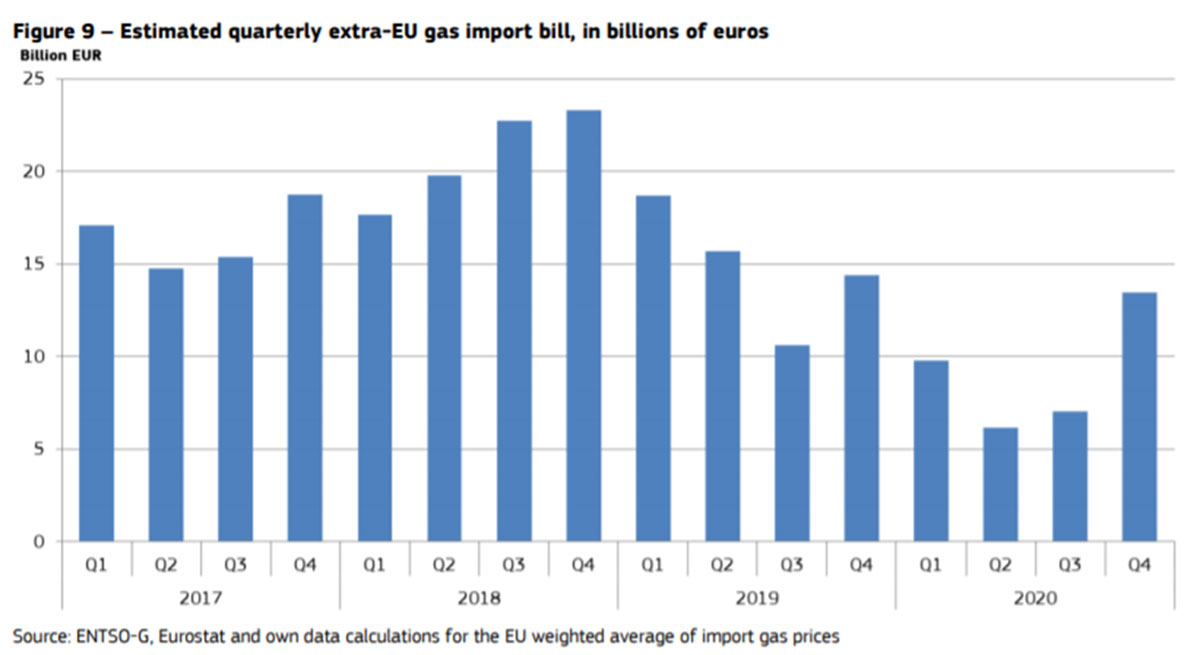

Under these circumstances, at EU level, the gas import bill last year was €36.5 billion, down from €59.4 billion in 2019 amid cheapening, according to the same report.

Source: ec.europa.eu/energy/

Romania's dependence on imports will increase without Black Sea gas production

Romania's natural gas production will reach 8.6 billion cubic meters this year, up from 11.2 billion cubic meters in 2016, and we will be importing more and more if gas is not extracted from the Black Sea, Sorin Gal, director of the National Agency for Mineral Resources (ANRM), recently drew attention to.

Last year, because of the pandemic and the drop in oil prices, all the big companies cut back on investment and stopped drilling wells, and the effects will be seen over the next three years.

"Romania had, in 2019, a production of 10.22 billion cubic meters of gas, both onshore and offshore, and in 2020 the quantity decreased by 9%, so we had 9.2 billion cubic meters, almost double the natural decline for producing fields. In 2021, production will continue to decline by another 8-9 percent"said Mr Gal, quoted by the publication Financial Intelligence.

According to him, this year's production will be 25% less than in 2015 - 2016. "So we will be left with 8.6 to 8.7 billion cubic meters. In 2015 - 2016 we have production of 10.8 billion, even 11.2 billion, so the decrease is dramatic", he pointed out. In this context, it is all the more important for Romania to exploit the significant resources in the Black Sea from the Neptun Deep field:

"We are in the last minute with this project. In 2021 the future of the Black Sea will be decided and it is important that we move to start producing", said Sorin Gal.

He reiterated that, according to ANRM estimates, there are between 200 and 400 billion cubic meters of gas in the Black Sea.

ANRE: We do not have the luxury to postpone investments in the exploitation of natural gas in the Black Sea

The urgency of starting production in the Black Sea is even greater in the context of new European regulations on decarbonising economies by phasing out fossil fuels in the long term. In a debate on the energy transition organised by the Council of Foreign Investors, Zoltan Nagy-Bege, vice-president of ANRE, warned that natural gas production in the Black Sea must start within two to three years, otherwise it will be too late and we will never be able to extract those resources. or "those deposits will no longer be economically viable".

"We don't have the luxury of postponing investments in Black Sea gas exploitation, the impact on the economy would be huge. My prediction is that if we don't start exploitation in two, maximum three years, there will never be gas production in the Romanian part of the Black Sea." said the ANRE official, quoted by Agerpres. In turn, Christina Verchere, CEO of OMV Petrom, said that 2021 is a key year for gas production in the Black Sea.

"Romania is a country with a long tradition in energy resources and must play a key role in the energy transition, and natural gas is of particular importance. I also believe that a favourable local context is needed. Time is not on our side and we are behind. So 2021 is a crucial year"said Christina Verchere.

She pointed out that Romania will be increasingly dependent on imports without natural gas from the Black Sea:"It's about energy security. Imports will increase to 40% by 2030. Time is of the essence. We can bring in gas, but we will pay taxes in other countries, employees in other countries. Investments in the Black Sea bring huge benefits to the country: jobs, multiple effects", said the oil company representative.

She concludes: "2021 is an absolutely crucial year. We need to see the legal framework in place to be able to develop these projects, as well as the tax regime." (source, HERE)

In the context of the authorities' plans to expand the natural gas distribution network, given the low level of connection to the network of Romanian localities, as well as the plans to build new natural gas power plants to replace coal-fired units, natural gas consumption is expected to increase, which, in the absence of production from the Black Sea deposits, will lead to even greater dependence on imports.

Proposed measures to increase production and strengthen energy security

Oil and Gas Employers Federation (FPPG) points out in a report that "Before the coronavirus outbreak, the oil industry was already under pressure as the world increasingly turned to renewables. The pandemic made the predicament worse."

According to the organisation, "The difficult economic context prevents the continuation of drilling campaigns as originally planned, and other important projects, thereby limiting or postponing the additional quantities of oil and gas to be produced in the future". Thus, "increasing the attractiveness of investment through a competitive, stable and predictable legislative and fiscal framework is of particular importance".

The main specific measures proposed by the FPPG to support the economic recovery of the oil and gas industry are:

- Urgent need to amend the Offshore Law to unlock the project Neptun Deep and thus support Romania's economic recovery;

- Insurance free market of gas and the elimination of the additional tax;

- Digitisation of the oil and gas industry - it is necessary that digitisation industry to be supported by changes in specific legislation that would allow technological developments aimed at compensate for the accelerated natural decline in production in the oil industry.

In addition, "it is essential that bureaucracy to be reduced both in the exploration and production sector and in the petroleum products marketing sector, so as to accelerate investments and other specific activities," the FPPG points out. More details can be found in the FPPG report, which is available here HERE.