Romania must intelligently exploit all the opportunities offered by the energy transition for the country's economic development. And one of the future directions is carbon capture and storage (CCS), a key technology for reducing global carbon emissions. With a rich history in the oil industry, Romania can become a major regional player in this sector.

As an EU member state, Romania is committed to achieving climate neutrality by 2050. Part of the solution to reducing the concentration of carbon dioxide (CO2) in the atmosphere is to capture these emissions from industrial processes and fuel combustion and store them underground - a process known as CO2 capture and geological storage (CCS).

Viitorul Energiei explains in the following infographic what this technology basically entails.

Beyond the environmental benefits of reducing emissions, the development of CCS projects is of strategic importance to ensure a sustainable future for some of the most important sectors of the national economy. CCS technology is explained in the following video:

"CO2 capture, transport and storage is an important option for the decarbonisation of energy-intensive industries (steel, cement, aluminium, etc.) as well as for the power generation sector, technology identified by the European Commission as a strategic pathway to achieving climate goals", according to a study conducted for the Oil and Gas Employers Federation (FPPG) by a consortium of the consulting firm Pricewaterhouse Coopers (PwC) and the think tank Energy Policy Group (EPG).

CCS's contribution to carbon reduction is significant, representing "between 16% and 90% emissions reductions in the iron and steel, cement, chemicals, fuel processing and power generation sectors," the study notes.

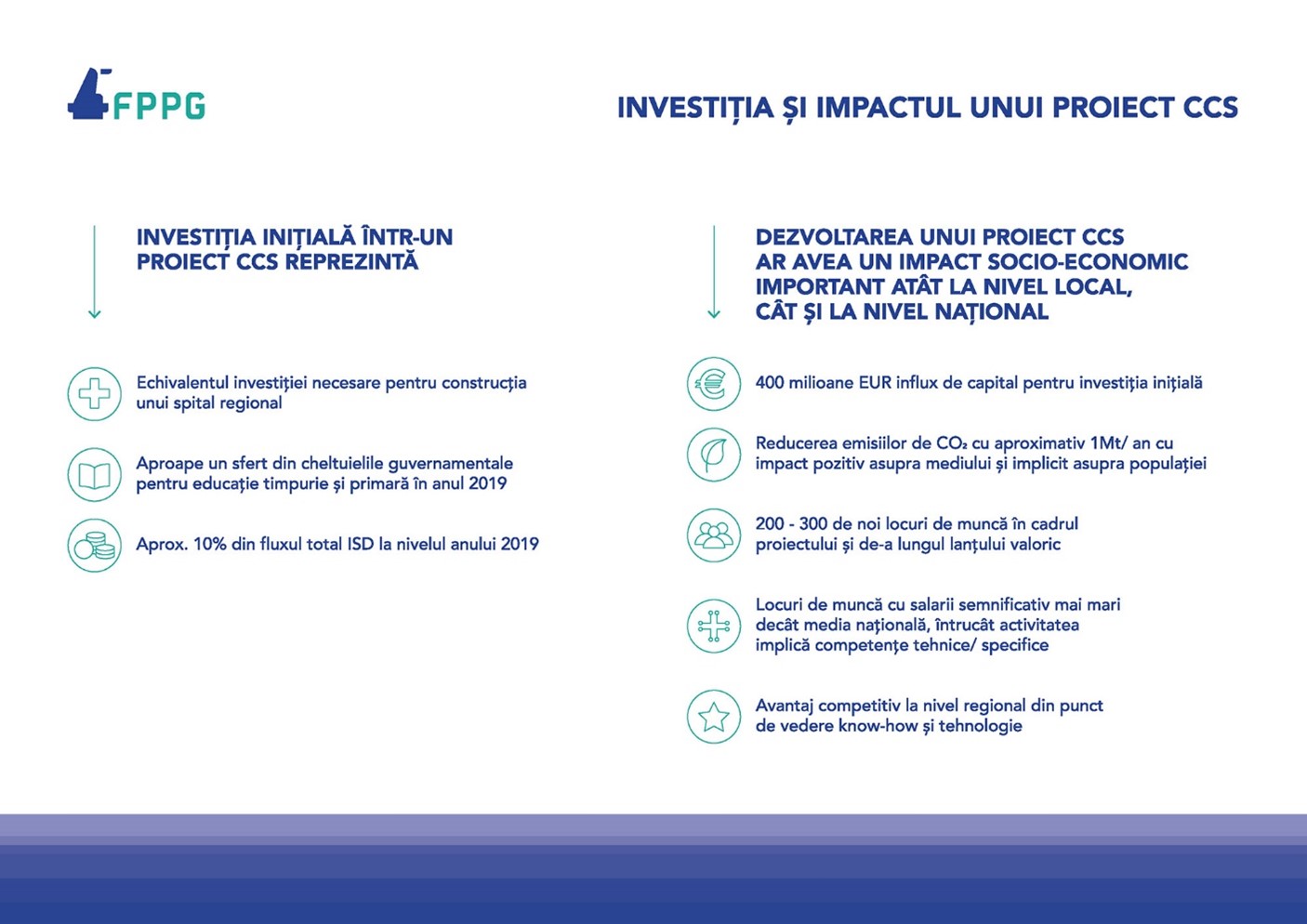

In addition to potentially preserving existing jobs in these industries, CCS technology also offers the potential to create new highly skilled jobs, direct and indirect, along the CCS value chain. The Federation of Oil and Gas Employers (FPPG) has summarised the socio-economic benefits of such an investment in the following infographic.

Romania could become a key supplier of CO2 storage in the region

But what is the development potential of this technology in Romania? Answers study conducted for the FPPG by PwC and EPG. CCS projects represent new opportunities for oil and gas companies operating mature or abandonment fields and those operating transmission networks.

"With over a century of industrial activity in oil and gas, Romania could become a key supplier of CO2 storage for other countries in the region. Existing wells and natural gas pipelines can be reused to transport and inject CO2 to help optimise upfront investments while increasing the country's competitive advantage.", the study said.

In addition to absorbing emissions from current energy processes, CCS is also developing a platform for blue hydrogen, a promising fuel for the energy transition, made from natural gas.

In the last decade, Romanian research entities have been consistently involved in EU-funded projects to explore the potential for CCS and CCU. Two such projects, which have already published relevant results, are due for completion in 2022 - Strategy CCUS and Rex-CO2.

According to the analysis of the European CO2 storage database, the total storage capacity in hydrocarbon fields in Romania is estimated at 514 million tonnes (Mt) CO2. Relatively equal shares of oil and gas deposits: 246.78Mt in oil storage and 267.56Mt in natural gas storage. Counties with the largest storage capacities in hydrocarbon fields are: Sibiu (1 deposit, 100Mt CO2), Gorj (3 deposits, 90Mt CO2) and Mures (3 deposits, 65Mt CO2).

Assessing both the largest CO2 emitters and the CO2 storage capacity shows six areas of interest for the potential development of an onshore CCS project(1) Gorj, (2) Dolj, (3) Galați - Buzău, (4) Mureș, (5) Vâlcea, (6) Prahova.

"Initial investment required for the development of a CCS project with a capacity of 1Mt CO2 per year in Romania ranges from EUR 326 and 455 million. The lifetime of such a project is estimated at 20-25 years. The capture process is close to 80% of the total cost of a CCS project, as it is more complex", the study adds.

However, there are numerous challenges in developing CCS projects in Romania. The legislation in place for CCS development is very fragmented as each stage of the process involves several hurdles. For example, no tender for storage permits has been held or announced so far, the study authors note.

What is the situation at global and European level. New CCS markets

The United States is pioneering the development of capture projects, carbon use and/or storage - CC(U)S - and are the world's largest hub, holding about half of the current operational projects. Europe was the second continent where CC(U)S projects were developed - in Norway in 1996 - and continues to be the second most important region in the world for CC(U)S development, thanks to North Sea storage area.

Data published in 2022 by the Global CCS Institute shows that globally, there have been dozens of projects announced and progressing through the development phase in the last 12 months.The storage capacity of all facilities under development has increased to 244 million tonnes per annum (Mtpa) - an impressive increase of 44%.

- A total of 61 new projects were announced in 2022, bringing the total to 30 CCS projects in operation, 11 under construction and 153 in development.

Global CCS Institute regional analysis shows that carbon capture and storage in Europe and the UK has seen a promising increase in projects over the past year. "Today, there are 73 CCS units in various stages of development in Europe and the UK. Important factors driving the momentum of CCS include European Commission programmes and measures in support of climate policy, including a increase in the number of projects funded by the EU Innovation Fund - a grant programme launched in 2020 to support the Commission's 2050 climate neutrality targets. Similarly, in the Netherlands, the subsidies for sustainable energy transition (SDE++), under which CCS projects are eligible for funding, has increased from €5 billion to €13 billion in the last year alone. Legislative proposals to introduce regulatory mechanisms in the EU that could further support CCS implementation, including carbon removal certificatesare under development", notes the Global CCS Institute.

More European countries enter the CCS market for the first time, including Bulgaria, Poland and Finland, thanks to access to grant funding through the EU Innovation Fund.

CCS funding in the European Union

The EU Innovation Fund, which aims to invest around €38 billion by 2030 in innovative clean technologies in Europe, announced its first successful grant recipients following the first and second calls for projects. Out of a total of seven successful applicants, Four projects selected in the first call in 2021 had a CCS component. CCS facilities in Finland, Belgium, Sweden and France to receive funding to support their CCS projects in hydrogen production, chemical industry, bioenergy and cement production respectively.

On the second call announced in 2022, seven CCS and CCU projects were accepted for funding. Projects were selected in Bulgaria, Iceland, Poland, France, Sweden and Germany, ranging from low-carbon cement production, storage site development to sustainable aviation fuel production.. The third call, launched at the very beginning of November this year, has a funding of around €3 billion.1.5 billion for the previous call in a effort to accelerate the environmental transition.

LARGE-SCALE CCS PROJECTS FUNDED BY THE EU INNOVATION FUND

The Global CCS Institute also presents a list of CCS projects funded by the EU Innovation Fund. Here are some of them:

- Holcim Germany's Carbon2Business project will modernize cement factory with CCS to capture over 1 Mtpa CO2.

- The ANRAV project will capture CO2 from Bulgarian cement factories and capture it will be stored in an offshore storage site in the Black Sea.

- Shell's HySkies project will produce sustainable aviation fuel through CCUS waste-to-energy operations in Sweden.

- Kairos-at-C will reduce 14.2 million tonnes of CO2 through a CCS cross-border value chain in Belgium, the Netherlands and Norwaywhich includes CO2 capture from hydrogen and chemical plants.

- BECCS@STHLM will capture and store 7.8 million tonnes of CO2 over 10 years from biomass plant Exercises from Stockholm.

- France's K6 programme will capture 8.1 million tonnes of CO2 from its cement factory, to be stored in the North Sea.

- The SHARC project in Finland will reduce CO2 emissions from a diesel refinery by green and blue hydrogen production.

So here is how CCS offers, beyond solutions for carbon reduction, huge opportunities for economic development through innovation. Romania has experience in relevant industries (such as oil and gas production) and significant CO2 storage capacity. But to take advantage of these opportunities, we need a coherent strategy and the right regulatory framework. More recommendations are available HERE.